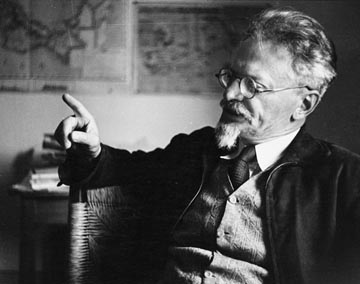

In two previous posts I have looked at Leon Trotsky’s transitional programme and the general approach to a working class programme which it encapsulated at a particular point in time. In this final post on the question I want to look directly at what Trotsky’s views were on nationalisation. As I said at the start of these posts, many organisations claiming inspiration from his politics place calls for state ownership high up in their political programme. This conflicts directly with Marx’s views but we need to look at Trotsky to see if this is also true of him.

In two previous posts I have looked at Leon Trotsky’s transitional programme and the general approach to a working class programme which it encapsulated at a particular point in time. In this final post on the question I want to look directly at what Trotsky’s views were on nationalisation. As I said at the start of these posts, many organisations claiming inspiration from his politics place calls for state ownership high up in their political programme. This conflicts directly with Marx’s views but we need to look at Trotsky to see if this is also true of him.

First we should note that in the transitional programme Trotsky explicitly counterposes ‘expropriation’ to “the muddleheaded reformist slogan of ‘nationalisation’”. He gives four reasons for doing so. The first is that he rejects ‘indemnification’, i.e. compensation to the capitalists. Secondly he does so as a warning against reformist socialists who, while also advancing this demand, nevertheless remain the agents of capitalism. Thirdly he says workers must rely on their own strength. As we have stressed, nationalisation relies on the state. Lastly he does so because he links the question of expropriation with the seizure of power by the workers. This latter point is crucial in his presentation while, because we live in less revolutionary conditions, I have laid greater emphasis on his third reason.

Thus in the very next section of the programme from that above, in which he argues the importance and the benefits of expropriation of the banks and statization of the credit system, he says that the latter will “produce these favourable results only if the state power itself passes completely from the hands of the exploiters into the hands of the toilers.”

When pushed, Trotsky accepts that ‘nationalisation’ may be accepted as a slogan but only in so far as it actually means expropriation and involves a workers’ government to achieve it. In other words reason four must apply.

It is possible to argue that the socialist programme must be taken as a whole and that therefore calls for nationalisation are perfectly valid when part of a comprehensive programme. There are several problems with such an argument but we will point out only two.

First – try finding the call for destroying the capitalist state or creation of a workers’ state in the programme of the left that might act as an alibi for demanding capitalist state ownership in the here and now.

Allied to this is the second reason. In every advanced capitalist country the working class is separated from conquest of state power by a huge gulf in social and political development and experience. The left might often be opportunistic but it is not immune to registering this fact, if only through avoidance of demanding overthrow of the state. In effect a link between nationalisation and a change in the character of the state is non-existent and the former becomes a simple call for the capitalist state to take ownership from private capitalists.

In other words the organ of the capitalist class as a collective, and its principal organ of defence of its system, is called upon to play a role in the destruction of this class and system.

For some on the left their understanding of Marxism and the working class political programme has degenerated so much that nationalisation of the economy is itself seen as the transformation of capitalism into socialism. In such circumstances however the relations of production remain unchanged; capitalism continues and the working class remains exploited, oppressed and separated from the means of production. It is precisely the establishment of this last condition that made for the creation of capitalism, and its ending that will signal capitalism’s overthrow, when the working class as the associated producers become owners of the means of production.

Trotsky was scathing about just such a belief in the socialist character of nationalisation. When talking about expropriating the banks he says that “of course this question must be indissolubly linked to the question of the conquest of power by the working class.” In the same article (Trotsky, Nationalised Industry and Workers Control, Writings , 1939) he writes that “It would, of course, be a disastrous error, an outright deception, to assert that the road to Socialism passes, not through the proletarian revolution, but through nationalisation by the bourgeois state of various branches of industry and their transfer, into the hands of the workers’ organisations.”

In many formulations of the call for nationalisation there is not even a call for nationalised property to be transferred to workers’ organisations, although the sometimes call for nationalisation under workers control is a nod in this direction.

We are thus left in the following position having reviewed Trotsky’s programme:

The socialist programme must be understood as a whole and it involves the destruction of the capitalist state and creation out of the working class itself of the new state.

In no country does the working class accept such a task or seek a way to achieve it. In no county is it subjectively revolutionary.

Trotsky seeks to adapt the working class and its political consciousness to its historical task but if it is not seeking revolution and has a very low level of political consciousness how do we proceed in a revolutionary way that does not address workers with politics that undermines the revolutionary goal?

Trotsky said that “comrades are absolutely right when they say we should tell the workers the truth, but that doesn’t signify that every moment, every place, we state the whole truth, starting with Euclid’s geometry and ending with socialist society. We do not have the right to lie to them, but we must present to them the truth in such form, at such time, in such place, that they can accept it.”

It would therefore be wrong to believe that because the complete programme of revolution cannot right now profitably be canvassed among the working class that the programme that must be fought for is less revolutionary. This is so only in degree but not in any qualitative sense. The revolutionary programme does not lose traction, does not cease to truly encapsulate the interests and immediate tasks of the workers because we cannot yet concretely and practically today propose the arming of the working class and destruction and replacement of the capitalist state.

What is also not involved is shying away from arguing outright for a socialist society, a society run by workers, and nor is it necessary or desirable to run away from this vision to the refuge of an improved capitalism. The vision of a systemic alternative to capitalism must capture the working class for it to put it into practice. It cannot be the result of stumbling blindly into it through some disembodied ‘logic’ of class struggle. Not speaking the whole truth every time and everywhere does not mean renouncing the goal of socialism at any time.

The revolutionary programme in non-revolutionary conditions means first rejecting illusions in capitalism and in its state – encapsulated in the demand for nationalisation.

It involves rejecting the substitution of the state for tasks that must be accomplished by workers themselves and it means identifying the steps forward that workers must take to develop their political consciousness, through increasing their economic, social and political weight in existing capitalist society.

There is no shortage of demands which can do so. It involves the demand for workers’ cooperatives – production without capitalists, not just as an answer to failing enterprises but as the model for new ones, through employment of workers’ pension funds and sponsorship by existing workers organisations such as trade unions. This is a question to which we shall return.

It involves workers reclaiming their organisations from the bureaucracies which currently control them through challenging and defeating these bureaucracies. In Ireland one form this takes is opposition to the policy and practice of social partnership. This in turn may involve creation of new trade unions; whether this is so is a practical and tactical question involving judgments that must ensure socialists and other militants do not become isolated.

It means creation of a workers political party that does not become the creature of electoralist stratagems and of TDs, as in the dying ULA. Similarly it does not mean the erroneous view that declarations of revolutionary virtue can in themselves guarantee anything in the wider working class, within which lies the only promise of revolution. The working class will of necessity learn from its own mistakes just as in will be its own liberator.

A programme which proclaims that the emancipation of the working class will be the achievement of the working class itself would go a long way to providing such a programme, were awareness of the dangers of reliance on the capitalist state for solutions as strong as it should be. It is arguing against such illusions, at what might seem excessive length, that many of the posts on this blog have been directed.

It is therefore time to turn to alternatives.

Does the demand for workers control represent such an alternative and does its joining together with a call for nationalisation represent a positive overcoming of the reactionary character of the latter – nationalisation under workers control? (Hint – the answer is no).

Does the call for workers cooperatives represent a real working class alternative to capitalism? Not, it would appear, to the organisations in Ireland’s left. But are they right?